Re-Insurance Service & Consulting

Con una experiencia acumulada de +35 años en el reaseguro de Ramos Técnicos y Daños, RISC ha estado asistiendo al mercado Latinoamericano con enfoque en grandes proyectos de infraestructura.

Proporcionamos a nuestros clientes la experiencia necesaria para afrontar los retos diarios de un entorno en rápida evolución.

Servicios de consultoría relacionados al reaseguro de ramos técnicos y daños.

35

Años

SUSCRIPCIÓN

RISC tiene mas de 35 años de experiencia en la Suscripción de Ramos Técnicos en Latinoamérica. Ofrecemos servicios de apoyo a suscripción de riesgos complejos, asistencia en determinación de PMLs incluyendo control de acumulaciones, así como capacitación a suscriptores de Ramos Técnicos.

INGENIERÍA DE RIESGO

Parte inherente de la evaluación del riesgo es la inspección, para reducir con las recomendaciones correspondientes la probabilidad de eventos catastróficos. RISC tiene amplia experiencia en varias industrias y sectores críticos, en donde una visita de campo detallada del riesgo puede ser determinante para controlar la siniestralidad.

RIESGOS DE LA NATURALEZA

Inspecciones de riesgo especializadas con la determinación de perdidas máximas probables para catástrofes naturales.

SINIESTROS

La correcta interpretación de los clausulados de Ramos Técnicos sigue siendo un aspecto controvertido en demasiado casos.

CAPACITACIÓN

Ponemos a disposición de nuestros clientes el know-how adquirido a lo largo de mas de 30 años como profesionistas en nuestro nicho de mercado.

SOLUCIONES ALTERNATIVA DE DISPUTA

Discreción, imparcialidad, y conocimiento profundos de los detalles técnicos son unos ingredientes que nos permiten presentar resoluciones ecuánimes.

MISIÓN

RISC pretende ser reconocida en la comunidad reaseguradora como un consultor profesional y técnicamente altamente calificado así como un proveedor de servicio de gran calidad para reaseguradores que tienen interés en Latinoamérica y requieren asistencia en las diferentes tareas implícitas de su actividad. La calidad de nuestro capital humano, nuestra experiencia, nuestras relaciones con el Mercado y nuestros conocimientos del entorno local, garantizarán la satisfacción de nuestros clientes. Mantener una ética profesional intachable y una transparencia absoluta en nuestras relaciones comerciales es nuestra máxima prioridad.

VISIÓN

Debido a un entorno económico cambiante, aspectos geopolíticos muy dinámicos, y la entrada de nuevos jugadores internacionales en la financiación de proyectos de infraestructura, el mercado de reaseguro latinoamericano está enfrentándose a retos continuos. Los eventos catastróficos, mismos que implican indemnizaciones siempre mayores, nos indican que el análisis de riesgo seguirá siendo un tema importantísimo dentro del contexto del reaseguro de Ramos Técnicos. En este entorno queda espacio para servicios de consultoría de alto nivel que puedan alocarse como un enlace entre el suscriptor de reaseguro y el proyecto reasegurado.

News Clips

Explosión en una Hidroeléctrica

16 de Abril, 2024

Hace unos días, en Italia ocurrió un siniestro catastrófico durante la puesta en marcha - después de unas obras de modernización tecnológica - en una central hidroeléctrica.Presentamos este caso como “case study” y advertencia para los interesados.

El Pequeño Reactor Modular (SMR)

23 de Enero, 2024

La creciente demanda de energías limpias ante la problemática del cambio climático, nos ha llevado a seguir de cerca las nuevas tendencias en la generación alternativa de energía eléctrica. ¿Puede la energía nuclear y las últimas tendencias en su desarrollo ser parte de una solución para la reducción de las emisiones de CO2? El Small Modular Reactor – en la fase inicial de su desarrollo – muestra un gran potencial.

Colapso de la Presa Chungthang, India

15 de Noviembre, 2023

Cambio climático: El desbordamiento repentino de un lago glaciar que desencadenó una avalancha resultando en la destrucción de una represa para la alimentación de una planta hidroeléctrica.

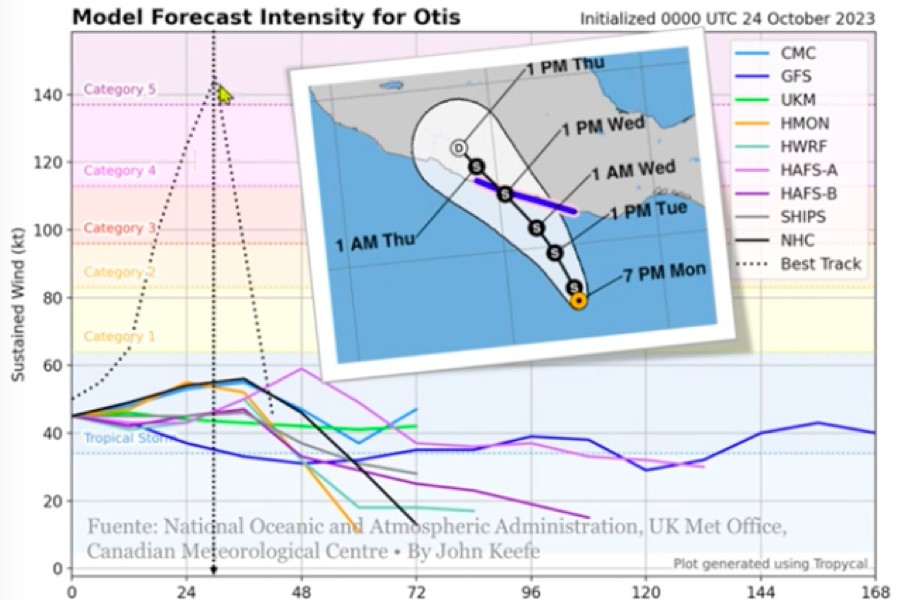

Huracán Otis

14 de Noviembre, 2023

Observaciones sobre el Huracán Otis que afectó Acapulco el 25.10.2023

Contáctanos

Síguenos